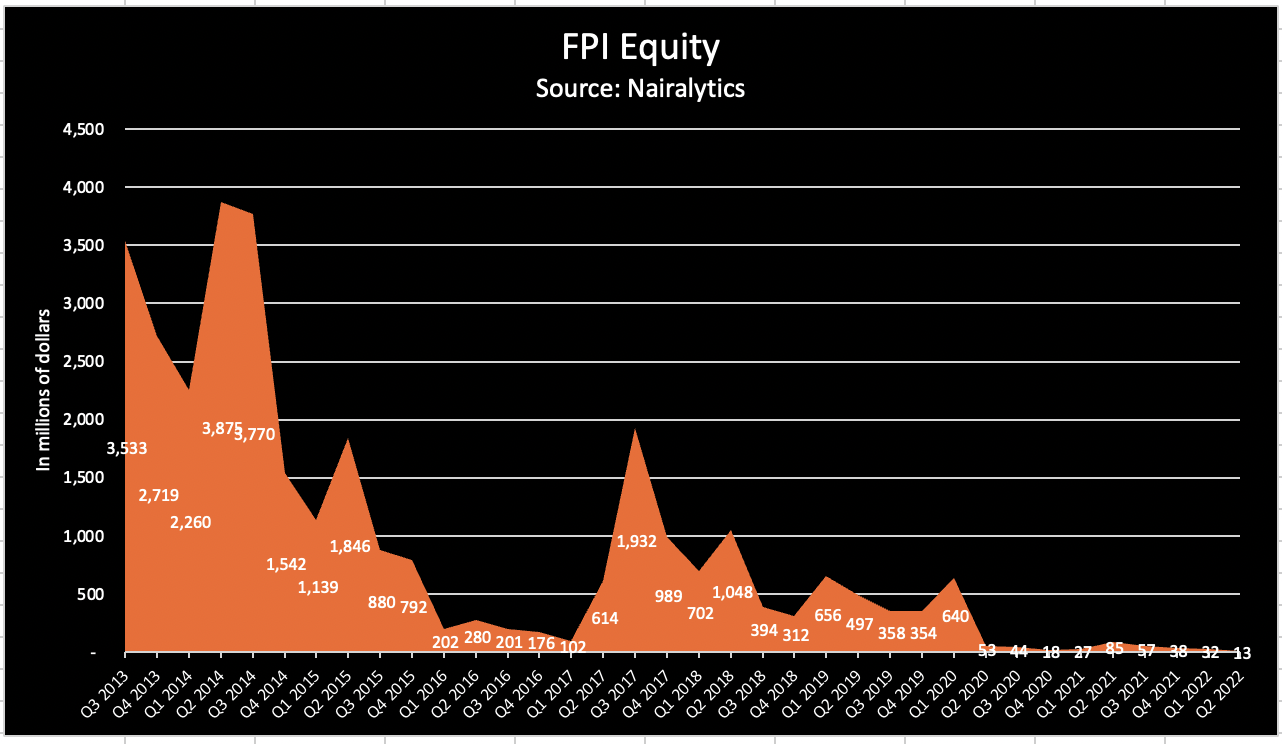

Foreign Portfolio in Nigerian equities fell to $12 million in the second quarter of 2022, its lowest level since the Bureau of Statistics started reporting the data.

This is according to second quarter capital importation data published by the National Bureau of Statistics during the week.

Total capital importation into the country rose to $1.53 billion up from $875 million same period last year. Total capital importation into the country in the first quarter of the year was $1.573 billion as foreign investments into the country continue to rise as the global economy opens.

FPI drastic fall

Nigeria has experienced a fall in capital importation since 2020 following the unwinding of the central bank’s open market operations policy that offered higher interest rates in exchange for foreign investor dollars.

Capital inflows also worsened following the global Covid-19 lockdowns that triggered major capital outflows out of emerging markets.

But while other sectors have improved albeit gradually, foreign portfolio investments into equity have worsened as investors avoid Nigeria’s stock market.

In the first quarter of this year, the figure dropped to $31.8 million while it was just $206 million for the whole of 2021.

In fact, total FPI inflows into the country since 2020 is a total of $1 billion which compares to $1.9 billion recorded in the 3rd quarter of 2017 alone.

The data also aligns with the report from the Nigerian Exchange which shows only N64 billion was captured as foreign investment inflow into the exchange.

What this means

Foreign investor apathy for Nigerian equities confirms transactions on the country’s flagship stock exchange are largely domestic.

In the past, foreign investors have driven investment inflows into the country with their money directly correlated with the rise or fall in the All-Share Index.

However, stocks have performed relatively well in the last three years and domestic investors have dominated investment participation in stocks.

The All-Share Index was up 50% and 6% in 2020 and 2021 respectively and 16.67% this year.

While this suggests Nigerian stocks have fared well in the absence or limited participation of foreign investors, the drop of foreign investor dollars has had negative connotations for the economy as seen in the exchange rate depreciation.

An increase in foreign investor dollars provides reliable liquidity for the forex market which in turn strengthens the exchange rate

|