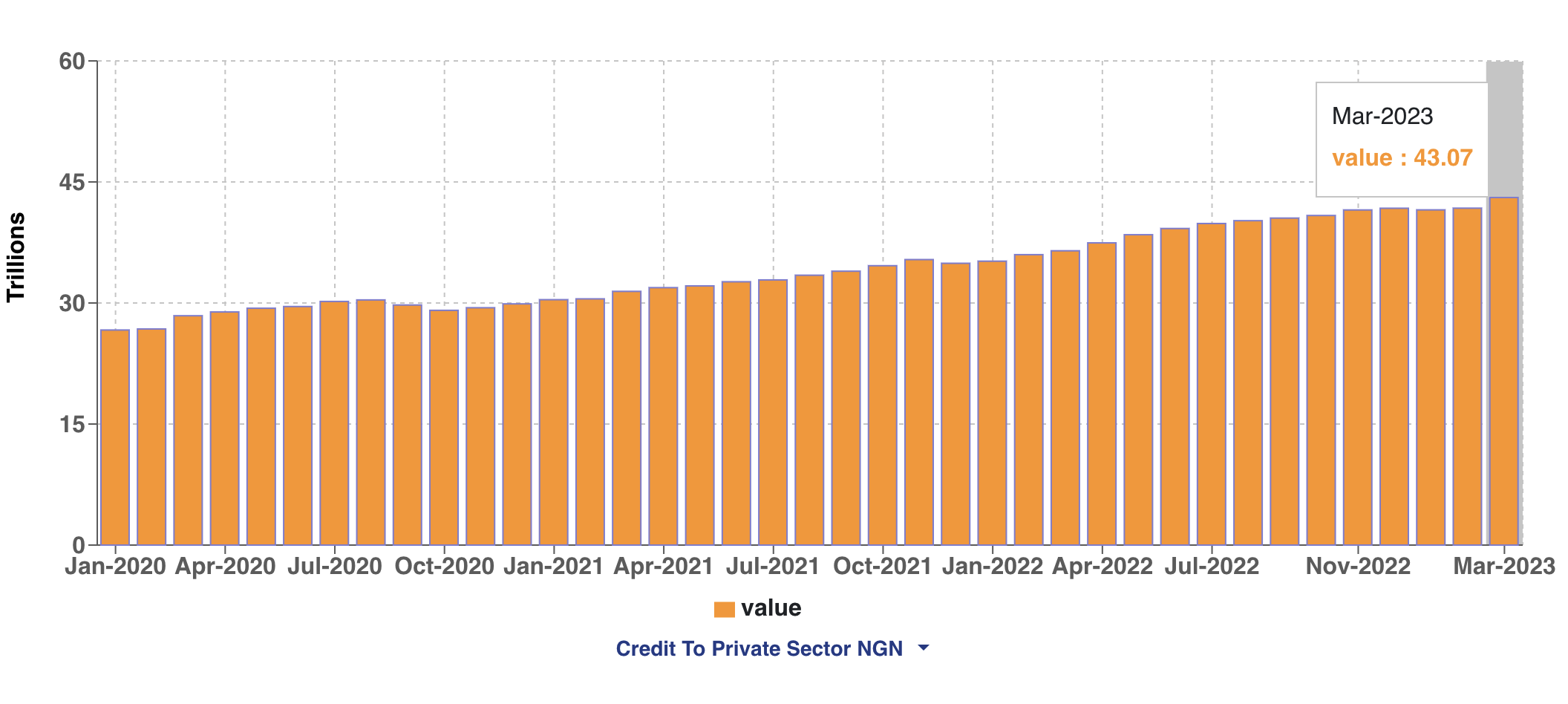

Bank credit to the private sector increase by N1.3 trillion, now N43 trillion

Loans issued to the private sector increased by N1.3 trillion to reach N43 trillion in Q1 2023 despite the CBN’s measures to reduce cash circulation.

Credit to the private sector includes various loan types, and the increase in lending could spur economic growth by providing businesses with capital for investment and expansion.

The rise in net loans to the private sector despite the central bank’s policies aimed at reducing cash circulation may suggest that banks are prioritizing lending to businesses over adhering to regulatory measures.

The total amount of net loans issued to the private sector rose to N43 trillion in the first quarter of 2023 representing a N1.3 trillion increase.

This is according to data from Nigeria’s central bank.

Credit to the private sector includes consumer loans, small business loans, commercial loans, structured finance, trade finance, mortgages, and all sorts of other loans issued to businesses and individuals.

Nigerian banks stepped up lending despite central bank policies aimed at reducing the amount of cash in circulation. The central bank has also raised interest rates in the last 5 monetary policy meetings citing galloping inflation and the need to contain the money supply.

However, the latest data suggest financial institutions gave out more credit to the private sector in the month under review. In contrast, total credit to the government fell slightly from N28.4 trillion to N27.5 trillion or N900 billion. This is also the second-largest drop in credit to the private sector since 2020.

Readings from some earnings guidance issued by commercial banks suggest they are not disposed to aggressive lending this year, which is why this data is a surprise.

What this implies

The increase in lending to the private sector suggests that Nigerian banks are willing to take risks and invest in the economy despite the central bank’s measures to reduce cash circulation and control inflation. This could help spur economic growth by providing businesses with the capital they need to invest in expansion, hire more workers, and increase productivity.

Most economists expect a slower GDP growth rate in the first quarter of 2023 mostly due to the impact of the old naira note crisis. The increase in credit to the private sector also explains why the central bank’s data on money supply showed it rose yet again to N51.1 trillion, yet another record for the central bank under Godwin Emefiele.

The decrease in lending to the government, this could have negative implications. The government relies on loans to fund its operations and investments in infrastructure, healthcare, education, and other critical sectors, especially as it continues to face fiscal challenges.

If the decline in government credit continues, it could lead to a reduction in public spending, which could stifle economic growth and hurt the standard of living for many Nigerians. Suppliers to the government may have experienced delayed payments due to the credit crunch faced by the government.

Nairametrics analysts believe the data suggests a delicate balancing act for the central bank. While it is important to control inflation and reduce cash circulation, policymakers must also ensure that there is sufficient credit available to both the private sector and the government to support economic growth and development.

|